Fintech is the second most widely adopted consumer technology, only behind the internet. The percentage of US consumers using technology to manage their finances had jumped to 80% in 2022. For comparison, it was only 58% in 2020. But what could have led to this widespread adoption of fintech by the masses? If you haven’t guessed, COVID led to the masses adopting fintech. If you recall, there were strict no contact policies in place during 2020-2022 because of Covid. People also preferred to remain distant in order to contain the spread of the virus. This provided an opportunity for the fintech industry to introduce no contact payment methods, such as G Pay, Venmo, and other NFC payment methods.

Now that fintech has reached such mass adoption, it is clear that it is not going anywhere. Fintech now is not only a consumer centric technology, it also includes industries such as education, retail banking, fundraising and nonprofit, and investment management to name a few.

What is Fintech?

Fintech, aka financial technology, is the use of technology to improve and streamline the delivery and use of finances. Now, most people think of cryptocurrencies and startup banks when they hear the term Fintech, but that was not always the case. Its roots can be traced back to the late 1800s, when the first electronic funds transfer system was introduced. This system used telegraph and Morse code technologies to transfer funds. Although basic by today’s standards, at that time, the ability to make financial transactions over a considerable distance was revolutionary. This can be referred to as Fintech 1.0.

Fintech 2.0

This era started in the late 1960s when the first ATM was installed by Barclays. Fintech 2.0 can be characterized by the switch from analog to the digitalization of finances. Then in the 70s, the world’s first digital stock exchange, NASDAQ, was introduced. This continued throughout the 80s with the rise of bank mainframe computers and the online revolution. The online revolution also changed the way people perceive finances.

Then, in the 90s, we saw the movement towards the digitalization of banking. PayPal was also introduced during the late 90s, hinting at the new payment systems to come.

Fintech 3.0

The Fintech 2.0 era lasted till the global financial crisis of 2008. Fintech 3.0 is the current era we are living in. It began in 2009 with the introduction of cryptocurrencies such as Bitcoin using blockchain technology. This was also the time when smartphones were adopted widely. With the widespread use of smartphones, they became the primary means by which people accessed the internet and other financial services.

It would not be wrong to say that this era is the era of startups. The appetite for innovation in investors and users is leading the way in this era. This has led to even established banks rebranding themselves as startups. And this has been the defining element of the Fintech 3.0 era.

What Consumers Believe?

As mentioned earlier, fintech is now the second most adopted consumer technology in the world, only behind the internet. But why is that? What do the consumers believe? For that, we checked out Plaid’s 2022 Fintech Consumer Survey, and here’s what we found.

- 58% of fintech consumers believed that fintech technologies helped them save time.

- 48% of users said that using fintech helps them feel they are in control of their finances.

- Another 46% of fintech consumers believed that it helped them save money.

- 34% of consumers using fintech said it helped streamline their finances and reduced the fear and stress of managing money.

- In addition to that, 27% of fintech technology users believed that using fintech helped them recover from financial mistakes.

These findings mean that our initial guess that the widespread use of fintech was due to Covid, was not entirely true. However, covid did prove to be the catalyst for it.

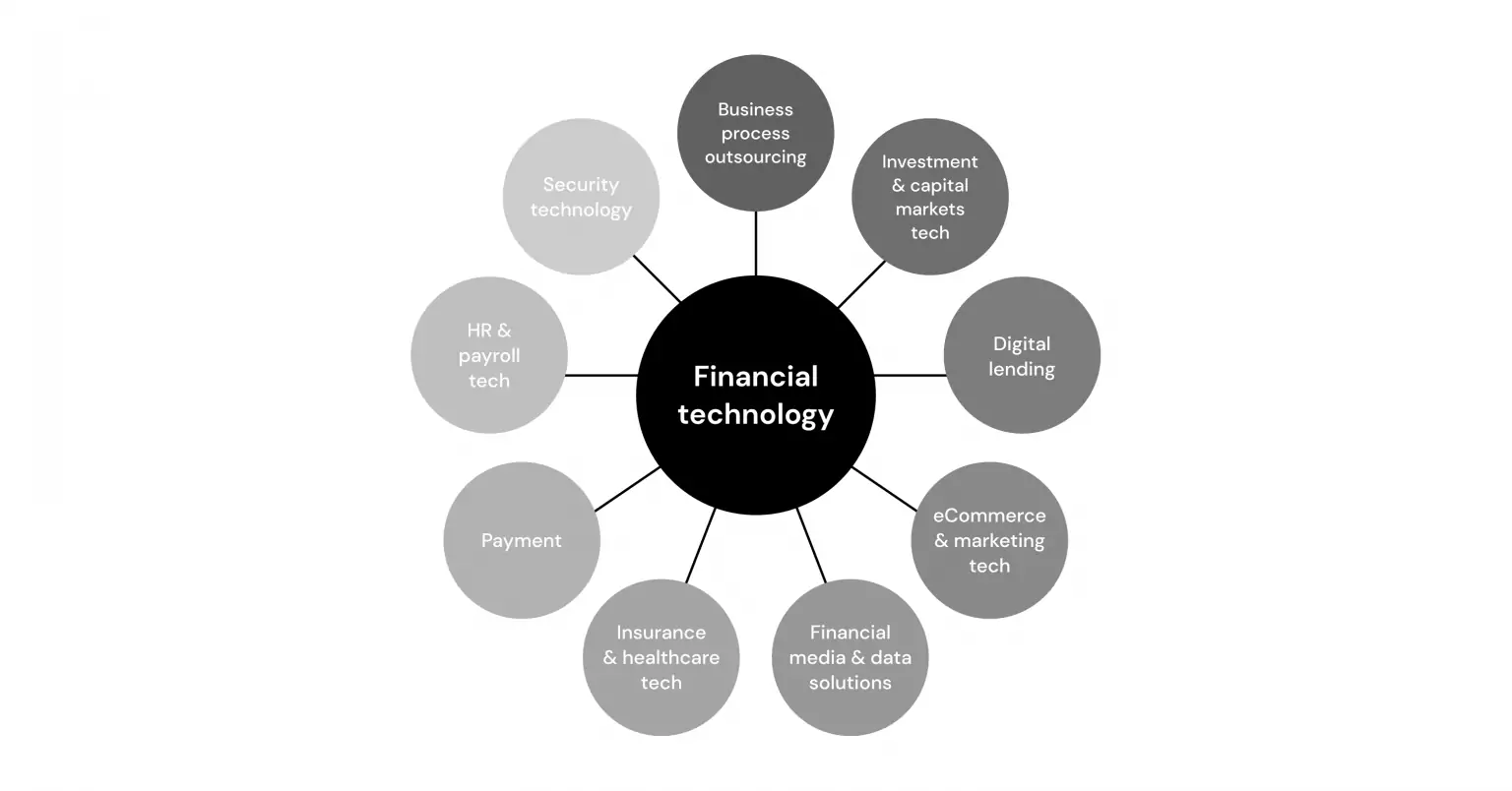

Types of Fintech

Fintech covers a lot of business-to-business (B2B), business-to-consumer (B2C), and peer-to-peer (P2P) markets. Here are some examples of the fintech companies and products that are changing the financial services industry.

1- Fintech Banks

Banks are one of the most central components of the financial system. These banking services have been shaken by the fintech technologies. Now the opening of new bank accounts and funding have become as easy as picking up your smartphone. It has also led to a reduction in fraudulent signups. Fintech offers all these banking services without the traditional bank fees, that might have been a hindrance for many in the past.

2- Digital Payments

Cashless payments are on the rise, and this has been the case since the pandemic. According to Pew Research Center, cashless payments have made a huge jump. With 41% of Americans saying that all their transactions within a week are cashless from just 29% in 2018. Payment apps and services have also become more and more common. This is due to the fact that receiving payments via direct bank transfer is less expensive than using credit cards. Getting users to sign up and the payment authentication process has become much more convenient and faster.

One such example of this digital payment service is Plaid. Plaid in the United States, allows users to connect their bank accounts with an app and pay instantly. This is also way cheaper than using credit cards.

3- PFM Apps

PFM stands for personal financial management apps. These apps are designed to help users consolidate their financial information from various accounts in a single dashboard. This makes it easier to stay up to date with finances. PFM apps also help users to manage, budget wisely, and make sense of their money.

One such example of a PFM app is Copilot. This app helps users make an accurate picture of their net worth and financial health.

Now that we’ve developed the basic understanding of what Fintech is and what are some of its types. Let’s look at how it impacts our lives.

“Experience secure and quick digital transactions with fintech.”

How It Impacts Our Lives?

As we all know we live in a continuously evolving digital first world. This means that the consumer’s expectations also evolve with the world around them. So far, the fintech industry has been able to match the consumer expectations at every turn. This is one of the many reasons for its unmatched success in recent times. But this means that fintech products must meet users’ expectations while helping them achieve economic well-being. And here are some ways fintech is impacting our lives and driving us to economic well being.

1- Accessibility

It is one of the most crucial ways fintech has impacted our lives. We no longer have to go to our banks and get in lines only to manage our finances. Thanks to fintech we can access and manage our finances from anywhere in the world. The only thing necessary for this is a stable internet connection. Accessibility also means the ability to connect with different apps and payment gateways like PayPal, Venmo, ApplePay etc. Fintech also allows consumers to pay bills through a banking app or a website, this also helps us save time.

2- Personalization

Personalization is a great example of the evolving user needs. Consumers have adapted to ride sharing, delivery apps, video conferencing, and other services that cater to their individual needs. This makes the consumer feel valued. Now, consumers want the same from fintech. This is possible through PFM apps which consider the user’s spending behavior and suggest a plan including savings, investments, pensions, and so on.

3- Control

Allowing control over our finances is another way fintech has impacted our lives. Consumers have a distinct desire to control their finances, as they should, after all it’s their money. Some HRM systems allow consumers, most probably companies, to do so by automatically generating payslips and providing programs to file taxes.

4- Security

Fintech uses consumer protection measures such as multi factor authentication when signing in or facial recognition. Thai helps consumers feel a sense of security regarding their finances. Moreover, payment gateways such as PayPal also give consumers a good amount of time for a chargeback if the consumers do not feel comfortable after paying for something online.

5- Financial Literacy

Another aspect that is somewhat connected to security is financial literacy. More and more fintech technologies have started to offer tutorials and detailed guidelines. This helps consumers navigate through the apps and manage their finances efficiently. Financial literacy is also crucial for the consumers to steer away from any phishing scams or cyber attacks.

Final Thoughts

The fact that fintech is only second to the internet in terms of widespread acceptance of technology should be enough to understand the impact it has had on our lives. Although fintech started in the late 19th century, it was only the Fintech 3.0 era (2008 – Continued) which led to the widespread acceptance of fintech. The introduction of smartphones during the same time and then the pandemic facilitated its rise. However, the real reason for fintech’s widespread use was the benefits it offered, as discussed in the sections above.